nc estimated tax payment voucher

PDF 21527 KB - January 06 2022. Amount of this Payment 00 Individual Estimated Income Tax NC-40 Web 8-16 Your Social Security Number Spouses Social Security Number City Your Last Name Your First Name.

Form D 422 Fillable Underpayment Of Estimated Tax By Individuals

Total Corporate Income Tax Due.

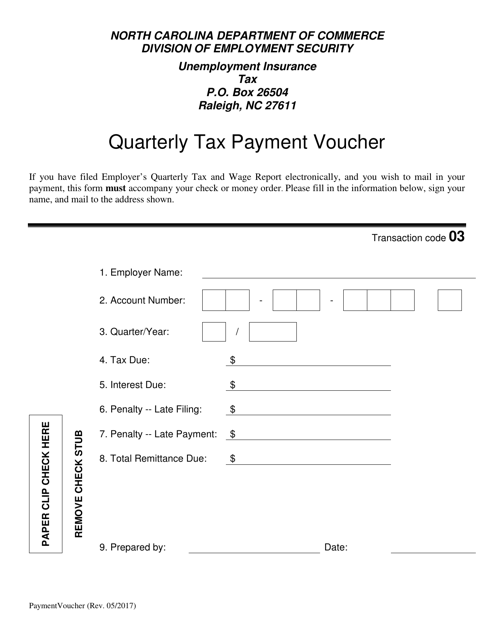

. Raleigh NC 27611. CD-429 Corporate Estimated Income Tax Payment Voucher. Unemployment Insurance Tax PO.

Quarterly Tax Payment Voucher - Chinese. Form NC - Individual Estimated Income Tax Form D -. 2022 NC-40 Individual Estimated Income Tax.

D-400V Individual Income Payment Voucher. Home File Pay Taxes Forms Taxes Forms. Click here for help.

Box 26504 Raleigh NC 27611. Total Franchise Tax Due. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax.

North Carolina individual income tax forms supported in TaxSlayer Pro. Schedule payments up to 60 days in advance. Country if not US Payment Amount whole dollar amounts 00.

Payments of tax are due to be filed on or before the 15th day of the 4th 6th 9th and 12th. PDF 11177 KB - November. Use the Create Form button located below to generate the printable form.

D-407V Payment Voucherpdf. Do not print this page. File Pay Contact Information Activity.

DIVISION OF EMPLOYMENT SECURITY. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Raleigh NC 27605 Please note that this is a secure facility.

052017 NORTH CAROLINA DEPARTMENT OF COMMERCE DIVISION OF EMPLOYMENT SECURITY Unemployment Insurance Tax PO. Use the Create Form button located below to generate the printable form. Home File Pay Taxes Forms Taxes Forms.

Customers needing assistance with their unemployment insurance claim should contact us via phone at 888-737-0259. Single Married Filing Joint Married Filing Separately Head of Household Widow. Estimated tax payments must be sent.

Do not print this page. Pay individual estimated income tax. Form CD-429 Corporate Estimated Income Tax is used to pay corporate estimated income tax.

Quarterly Tax Payment Voucher - English. Quarterly Tax Payment Voucher. Enter Your Information Below Then Click on Create Form to Create the Personalized Form CD-429 Corporate Estimated Income.

Want to schedule all four payments. You can also pay your estimated tax online. Individual Income Tax Sales.

NC-429 PTE Pass-Through Entity Estimated Income Tax. Estates and Trusts Payment Voucher. Make one payment or.

To pay individual estimated income tax. Printable North Carolina Income Tax Form NC-40. Quarterly Tax Payment Voucher - Chinese.

NORTH CAROLINA DEPARTMENT OF COMMERCE. Pay Original Tax Payment CD-V Pay Amended Tax Payment CD-V Amended Contribute to the North Carolina Education Endowment Fund NC-EDU Handwritten Payment or Extension.

1040 Es 2015 Estimated Tax Payment Voucher 4

Blank Income Tax Forms American 1040 Individual Income Tax Return Form Papers With Empty And Unfilles Lines Stock Photo Alamy

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

Nc Estimated Tax Payments Fill Out Sign Online Dochub

Tax Pros Horrified By Irs Decision To Destroy Data On 30 Million Filers

California Tax Forms 2021 Printable State Ca 540 Form And Ca 540 Instructions

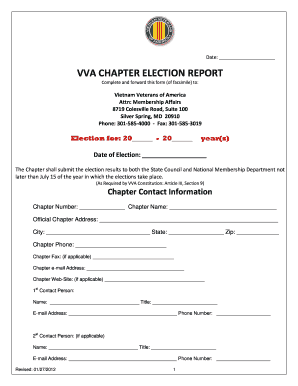

How To Do Payroll In North Carolina Detailed Guide For Employers

First Filing Deadline Of 2012 Final 2011 Estimated Tax Payment Due Jan 17 Don T Mess With Taxes

Nc Dor D 400tc 2014 Fill Out Tax Template Online Us Legal Forms

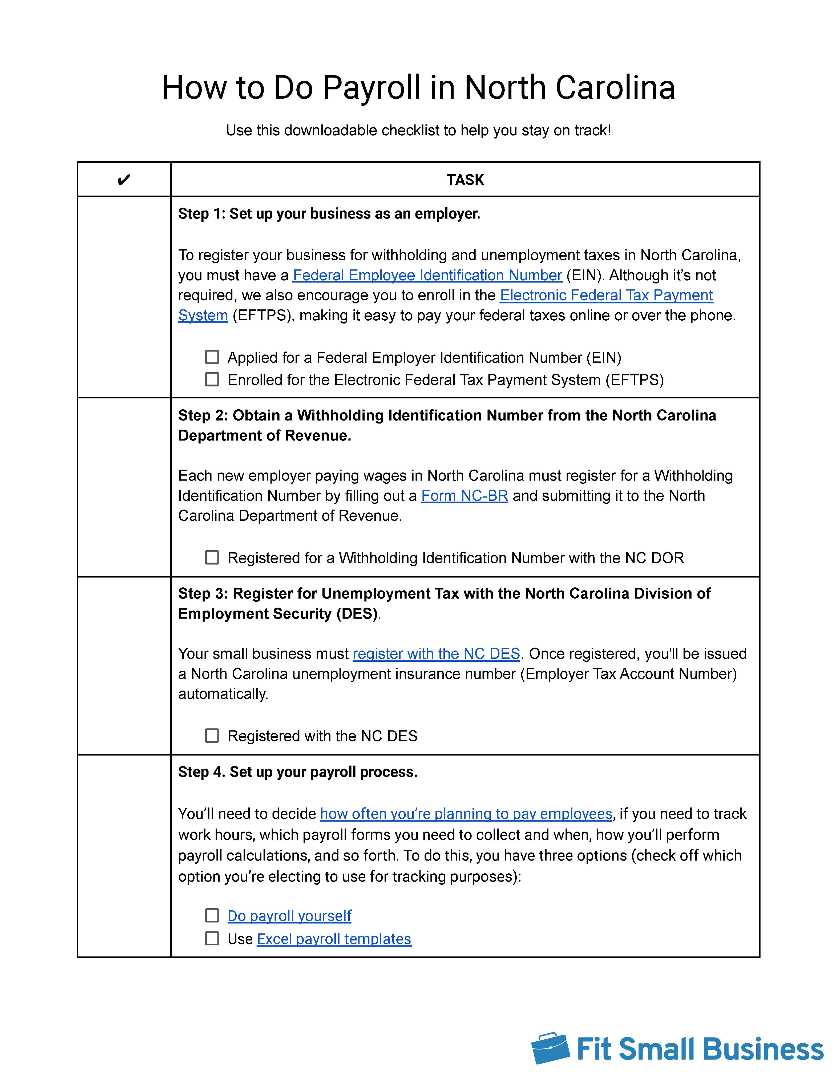

Nc Estimated Tax Payment Fill Out Printable Pdf Forms Online

Nc Estimated Tax Payments Fill Out Sign Online Dochub

Nc Estimated Tax Vouchers Fill Online Printable Fillable Blank Pdffiller

Ohio Tax Forms 2021 Printable State Ohio It 1040 Form And It 1040 Instructions

North Carolina Quarterly Tax Payment Voucher Download Fillable Pdf Templateroller

Nc Estimated Tax Payment Fill Out Printable Pdf Forms Online

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes